If you are lucky enough to have a 401(k) with a company match, then putting money in up to your company match is a no-brainer. After all, if you don’t… you are leaving money on the table.

But of the 56% of employers who offer a 401(k) plan, only half also offer a company match. That got me to wondering… Should I put money in my 401(k) if there is no company match?

What Exactly is a 401(k) and What’s the Big Deal?

If you could save yourself $5,850 in taxes this year, would you do it? I mean… who wouldn’t?

That is the power of a 401(k) plan. If you contribute the max to a 401(k)—$19,500 in 2020 and 2021 (up to age 50), that is what you are saving from Uncle Sam, assuming a 30% marginal tax rate.

On top of that… that $5,850 that would have been paid to Uncle Sam, set aside in a tax-deferred savings account with a 10% annual return without adding anything else to it, will grow to $102,079 after 30 years!

So the big deal about 401(k) plans:

- They lower your taxable income today

- Tax deferred accounts help you grow your money faster

- 401(k) plans are easy to set up, even for those who don’t feel financially savvy

If 401(k)s are so great, why wouldn’t I want to contribute to my plan?

When your employer creates a 401(k) plan for you, they pre-select a limited portfolio of investment options that they then make available to you.

This makes it easier for you as an employee… after all… you only need to choose from a small pool of plans, rather than a zillion-ish (yes, that’s an official count) options out in the open market.

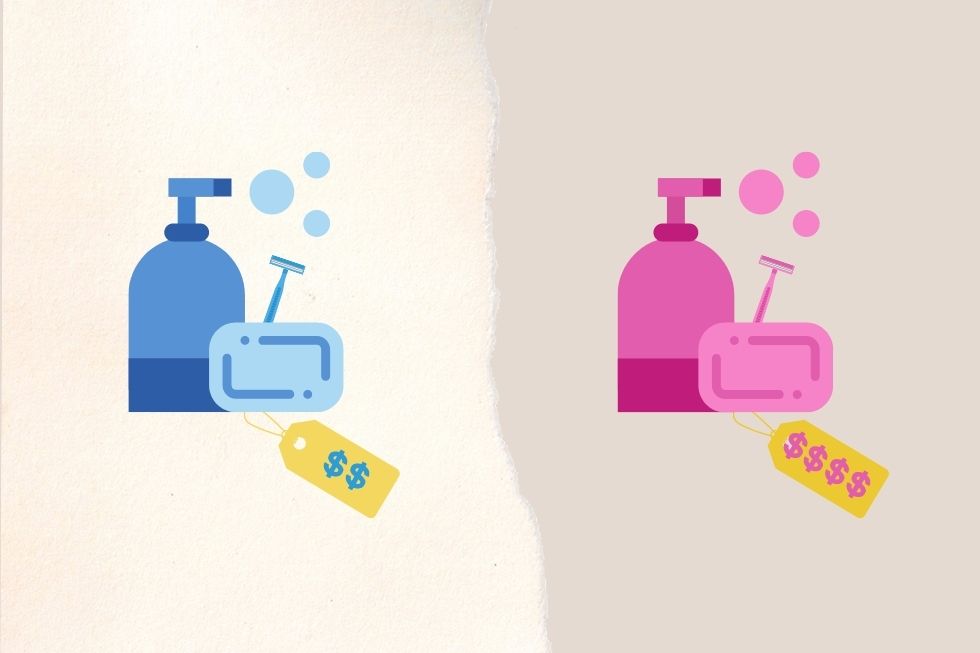

The downside is that while employers have a legal responsibility to ensure their 401(k) plans operate in the best interest of their employees as a whole, that doesn’t always mean the lowest cost, highest return plans for you.

On top of that, there is an administrative cost to setting up a custom portfolio of plans.

All of this means that 401(k)s often come with higher fees for you (administrative, investment and service fees) than what you have access to in the open market.

And what about a company match… isn’t that “free money”?

Some companies offer employees an incentive to contribute to their 401(k) programs through a company match. That means for every dollar you put in (up to a predetermined cap) the company will also contribute a set amount to your plan.

Companies are not required to offer a company match, but if they do, they have already budgeted that spend on their books, and you are literally leaving money on the table if you don’t take advantage of that.

So…What should I do if my company does not match 401(k)?

If you’re among the 49% of people who have a company 401(k) plan with no company match, what are your options?

First, it is always a good idea to make sure you have a fully-stocked emergency fund… you know… for when, not if, sh*t hits the fan. General guidelines recommend having 3-6 months worth of living expenses stashed away for a rainy day.

If you’ve got your bases covered there, an IRA might be your next best bet. An IRA is an individual retirement account with tax benefits similar to a 401(k). That said, with an IRA you have 1) unlimited investment options so you can select the best investments for you, and 2) generally lower fees than an employer sponsored plan will have.

Now, there is a limit to how much you can contribute to an IRA each year (up to $6,000/yr if you are up to 50 years old for 2020 and 2021 tax years), but why not take advantage of any tax breaks you can?

Wait… IRA? or 401(k)?

If you’re the kind of person that wants it all, the upside is that having a 401(k) and an IRA in the same year is not an either-or situation. You can have both.

So with no company match on your 401(k), a common strategy is to first max out your IRA, and then contribute to your employee sponsored 401(k) plan… taking advantage of the tax deferred savings of both!

So why would you want to still contribute to a company 401(k) plan when there is no company match?

The major benefit of 401(k) will pay for itself many times over—tax deferred savings.

Because you are not paying taxes on the money you put into a 401(k) today, you are able to instead earn interest on that same money that you would have paid to Uncle Sam—when you compound that over time, it adds up… in a BIG way.

Why tax deferral matters

| Tax Deferred Account (401(k)) | Taxable Account (Savings/brokerage) | |

| Starting amount | $10,000 | $10,000 |

| Annual interest rate | 10% | 10% |

| Combined federal and state marginal tax rate of 30% | 30% | 30% |

| Adjusted interest rate | 10% | 7% |

| Acct balance after 30 years (No additional contributions) | $174,494* | $76,123* |

And that’s assuming you make no additional contributions.

Using the same scenario as above, if you continue to contribute an additional $10,000/yr, you will have an additional $820,378 saved if that money is invested in a tax-deferred account after 30 years!

| Tax Deferred(401(k)) | Taxable(Savings/brokerage) | |

| Acct balance after 30 years(Annual contribution of $10K) | $1,907,231 | $1,086,853 |

So, is 401(k) worth it if your employer does not match?

I would say absolutely. Even without a company match, you can take advantage of:

- Tax deductible savings today

- Tax deferred growth on your investment

- An easy way to save with your employer

Feeling overwhelmed?

Honestly, don’t sweat it. You can keep it simple. At the end of the day, many financial experts agree that which retirement account you choose is less important than simply saving money.

So if you don’t know where to start, start saving wherever feels easiest for you.

If investing feels scary or overwhelming and your company 401(k) feels manageable, then do that! (Even if there is no company match.) You will come out much farther ahead by contributing than by not.

Commit to contribute a portion of every single paycheck to a retirement savings plan, from now until the day you retire.

As you’ve seen, the compounding effect of money takes time. You can’t start a few years from now and expect the same results. Start today.

And remember… no decision is permanent. If you contribute to your company 401(k) and then decide later you’d like to diversify your portfolio, you can always adjust future contributions. Don’t let overwhelm stop you from saving today. Don’t wait for the perfect time to … NOW is the perfect time.

So that’s a ‘yes’ to my 401(k)?

Again, when thinking about whether it makes sense to invest in a company 401(k) if there is no company match, keep it simple. If you feel overwhelmed and don’t know where to start, and your company 401(k) makes it easy and do-able for you, then do it!

If you want to get more sophisticated, then you can start exploring other options like a self-directed IRA, Roth IRA or other investment options. But at the end of the day, don’t overwhelm yourself. Sticking with the basics is better than doing nothing at all. Just keep saving—slow and steady wins the game.